In the words of comedian Chris Rock, “You don’t pay taxes — they take taxes.”

When you are given an opportunity not to pay taxes, do you take it?

By planning ahead and taking financial advice you can ensure you are minimising the tax you pay now and in the future by taking advantage of the tax exemptions and allowances available to you.

Our clients know that we help them manage their tax affairs efficiently by utilising all the allowances and exemptions available, such as the following:

- ISA’s are a savings account that is free from tax. The ISA allowance for the 16/17 tax year is £15,240.

- Capital Gains allowances let you utilise gains of up to £11,100 without any liability to tax.

- Pensions are a long terms savings plans with tax relief available. Your contribution will increase by at least 20% in the form of tax relief by just paying into a pension. You are allowed to invest a 100% of your earnings or £3,600 whichever is higher up to £40,000.

- Inheritance planning gives you an opportunity to gift £3,000 per person for this tax year, and the previous tax year (if not used) without being liable for inheritance tax.

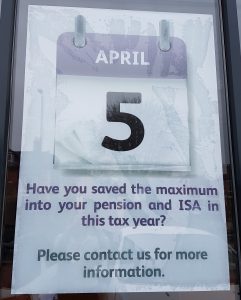

It is essential to seek financial advice for tax planning purposes as you save for your future. On the run up to the tax year end we welcome you to get in touch for a financial review to ensure you have taken advantage of tax incentives available to you.

We look forward to hearing from you.