One of our clients was kind enough to bring some fresh produce in the other day from his allotment.

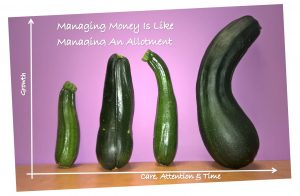

After a few ribald jokes around the size of his courgettes, we took a couple of photos and it struck us that cultivating an allotment can have several similarities to managing an investment portfolio.

When starting with an investment plan or an allotment you only have a finite amount of space or funds to start with. So it’s not good practice to commit all your space or funds to one single produce.

A single investment or crop may give good returns for one year but over time it will stumble as most things are cyclical and benefit from rotation and diversity.

Once you have set up and planted your allotment you need to maintain it so that it continues to flourish, ensuring that any tweaks are made as the seasons evolve.

Equally, an investment portfolio is no different as you look to rebalance or move from one asset class to another.

Overall, there is one truism that can be applied to both activities and that is that growth comes from time, care and attention.

Platinum are always happy to review clients plans so if you, or anyone you know, would like to chat things through then please get in touch.